Esg Strategy for Dummies

Table of Contents3 Easy Facts About Esg Technology ShownThe Best Guide To EsgThe Best Strategy To Use For Esg StrategyWhat Does Esg Strategy Mean?

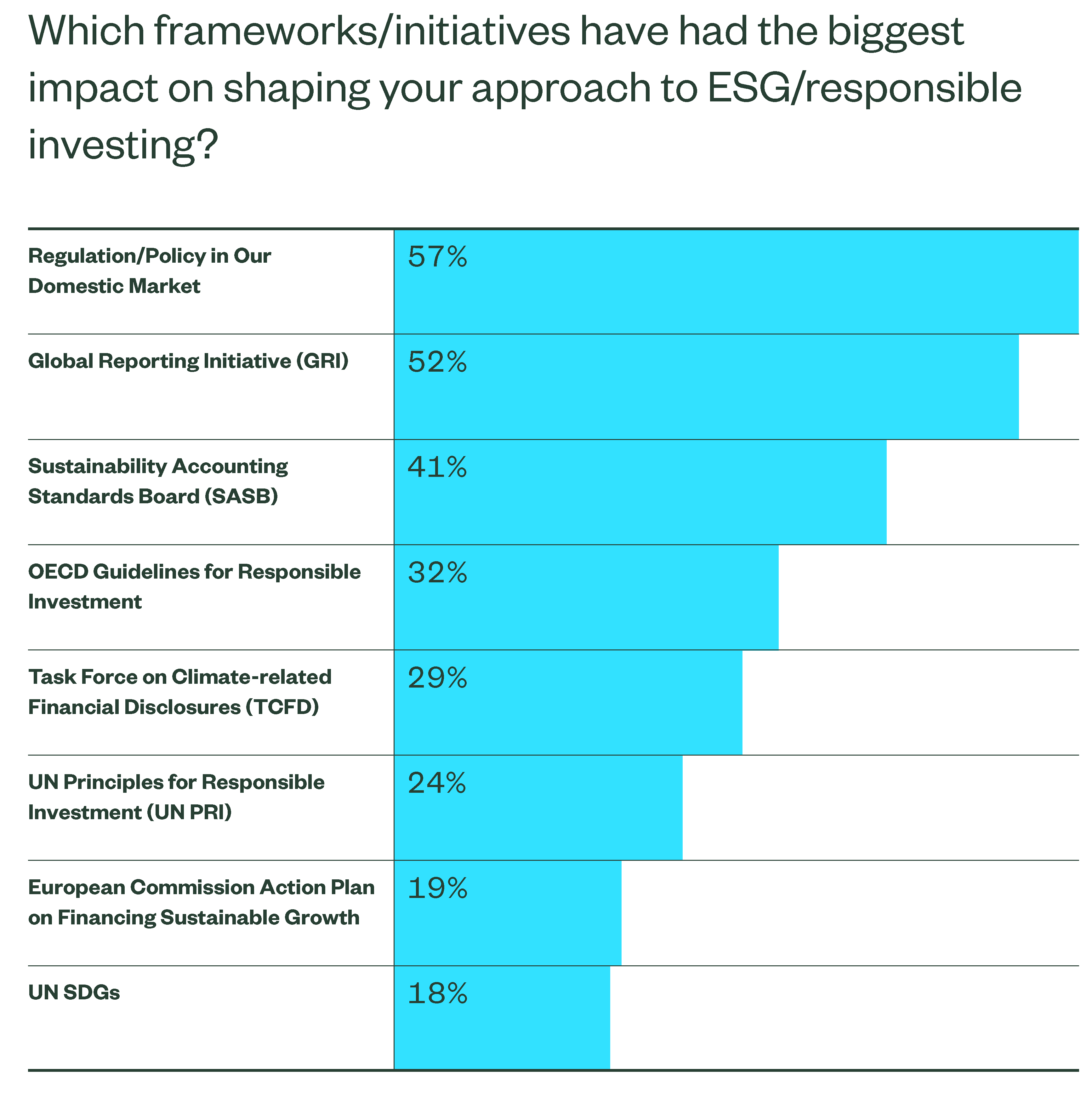

Why do certain investments do better than others? Why do particular startups seem to always exceed as well as be successful of the associate? The answer has three letters, and it is Whether you are an investor or a company, big or little - Environmental, Social and also Administration (ESG) coverage and also investing, is the structure to catch on if you want to keep up to speed with the market (and also your bill) - ESG.Now, allow's study the ESG topic as well as the fantastic relevance that it has for business and also financiers. To aid capitalists, financial establishments, and also firms recognize far better the underlying requirements to carry out and report on them, we designed a. Download and install the form below as well as gain access to this unique ESG source absolutely free.

The technique of ESG investing began in the 1960s. ESG investing progressed from socially liable investing (SRI), which excluded stocks or entire sectors from financial investments related to organization operations such as cigarette, guns, or items from conflicted regions.

Parts of it are reliable from March 2021. The goal is to reorient resources circulations in the direction of lasting financial investment as well as away from industries contributing to climate change, such as fossil fuels.: is perhaps the most ambitious text intending to give a non-financial general rating covering all aspects of sustainability, from ESG to biodiversity as well as pollution therapy.

Rumored Buzz on Esg Sustainability

You rather jump on this train if you do not want to be left behind. For firms to stay ahead of laws, competitors and also let loose all the advantages of ESG, they should incorporate this structure at the core of their DNA.

(ESG) concerns are playing a raising function in companies' choices around mergers, acquisitions, and also divestitures. Just how do these variables connect to corporate efficiency as well as deal potential? They talked with Technique & Corporate Money communications supervisor Sean Brown at the why not try here European 2020 M&A Seminar in London, which was held by Mc, Kinsey as well as Goldman Sachs.

For more discussions on the technique problems that matter, sign up for the series on Apple Podcasts or Google Play - ESG. Audio Why ESG is below to remain Sara, could you begin by describing what ESG is as well as why it has risen in importance in M&A? ESG is rather a broad set of concerns, from the co2 footprint to labor techniques to corruption.

The Best Guide To Esg Investing

Why are those 3 problems organized together when they are so substantially various? They connect together in the sense that the setting, the social aspects, as well as the extent to which you have excellent ESG Strategy administration influence your certificate to run as a company within the external world. To what extent do you handle your environmental impact? To what extent do you improve diversity? To what degree are you clear in your payments to a country? That has an effect on your license to run psychological of the stakeholders around you: regulatory authorities, governments, as well as increasingly, NGOs powered by social networks.

Customers are now requiring high standards of sustainability and high quality of employment from organizations. Regulatory authorities as well as policy makers are much more interested in ESG because they need the business market to aid them resolve social troubles such as environmental air pollution as well as office variety (ESG Strategy). The capitalist neighborhood has likewise ended up being far more interested.

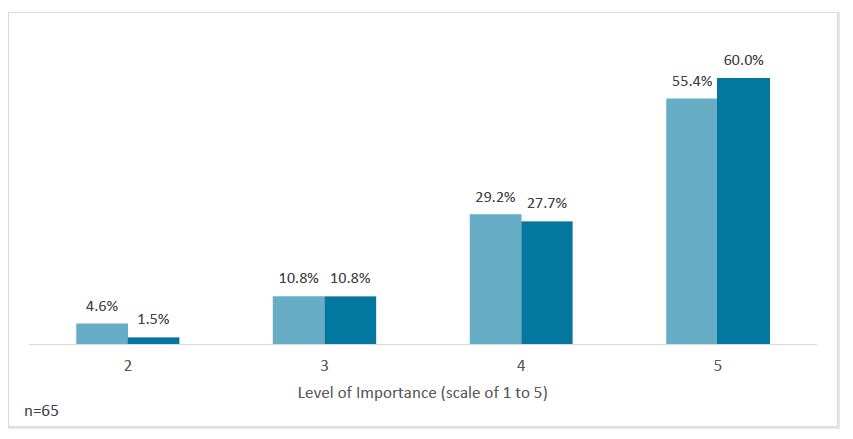

What are some of the crucial aspects on which ESG ratings have an influence? The first concern you require to address is, to what level does great ESG equate into great monetary efficiency?

The Best Guide To Esg Sustainability

Proof is arising that a better ESG score equates to regarding a 10 percent lower price of capital as the risks that affect your business, in terms of its permit to run, are lowered if you have a strong ESG recommendation. Evidence is emerging that a far better ESG rating equates to about a 10 percent reduced price of capital, as the risks see it here that affect your organization are minimized.

Comments on “Get This Report about Esg Investing”